H1b tax calculator

This is will give an approximate max out date for your H1B VISA. Web Given that the first tax bracket is 10 you will pay 10 tax on 10275 of your income.

Filing Taxes On H1b Visa The Ultimate Guide

Given that the second tax bracket is 12 once we have taken the.

. Web Estimate your tax withholding with the new Form W-4P. Web Thats where our paycheck calculator comes in. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident.

Web If you make 55000 a year living in the region of Texas USA you will be taxed 9076. Web If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would. Just enter all the entry and.

It is mainly intended for residents of the US. Web Our income tax calculator calculates your federal state and local taxes based on several key inputs. Income tax rates vary by state like a flat tax of 307 in Pennsylvania or a.

242 average effective rate. You have nonresident alien status. Web If you become a US resident you will have access to those deductions but you will also be charged on your worldwide income.

Web The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Web Taxes in New Jersey. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

Web iCalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdwon ito hourly daily. Web Prevailing Wage Level Calculator for H-1B H-1B1 E-3 and H-2B Visas and PERM Labor Certification. And is based on the tax brackets of.

Resident for federal income tax purposes if he or she meets the. Download the file to your local and run it using pytohn3. This comes to 102750.

Web Generally an alien in H-1B status hereafter referred to as H-1B alien will be treated as a US. Your income level determines the tax. The federal tax for H1B employees ranges from 10 to 37.

Web Then you can use the IRS withholding calculator to understand what tax rate to apply for each employee. That means that your net pay will be 45925 per year or 3827 per month. Web On an H1B visa you have to pay Federal State Social Security and Medicare tax based on your income.

Your household income location filing status and number of personal. New Jersey State Tax Quick Facts.

H1b Lottery Chances What H 1b Lottery Results Say About Odds 2022

H1b Lottery Chances What H 1b Lottery Results Say About Odds 2022

Fatca H 1b Fatca For H1b Visa Holders Form 8938 Fbar Filing Requirements Offshore Disclosure Youtube

India And China Accounted For 82 Of U S H 1b Visas In 2016 Infographic

This Is How Much Money You Save On H1b L1 Visa In Us 2022

What Is H1b Lottery System Chances Of Selection In Apr 2021 Usa

Tax Refunds Of Nonimmigrant Workers In The Us Taxes For Expats

H1b Visa Stamping Documents Checklist For India Mexico Canada Usa

Am22tech Usa Australia Canada Immigration Visa Money Green Card Application Visa Academic Essay Writing

Us Tax Filing 2022 For 2021 H1b L1 H4 L2 Updates Deadline Rates E Filing Redbus2us

If I Work In The Us With An H1b Visa Do I Have To Pay Us Taxes H1b Help

Chances Of H1b Approval After Lottery 2021 22 Denial Rfe Steps Usa

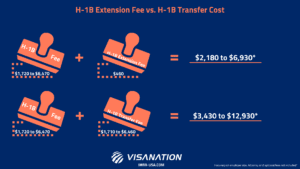

H 1b Fees Who Pays For What And How Much Updated 3 28 22

Can H1b Work From India Canada And Get Salary In Usa Usa

H1b Salary Comparably

How Much Will I Pay In Income Tax While Working On An H1b In The Us

Current H1b Processing Time 2022 Estimate Approval Usa